[adinserter name=”CoinAdsenseRotation”]

[adinserter name=”CoinAdsenseRotationMobile”]

Late in the US evening, as night came and asia woke up, a major Bitcoin Outflow from Binance.

A quick analysis showed some correlation between the news, a reopening to China’s cryptocurrency trading (https://www.cdex.cn/), and from the chart showing correlation with price:

Closed analysis? Not exactly. Onchain data is now within everyone’s reach, and similar movements can trigger euphoria and price movements, it has happened many times before . Manipulation is part of the system, and this is what has most likely happened.

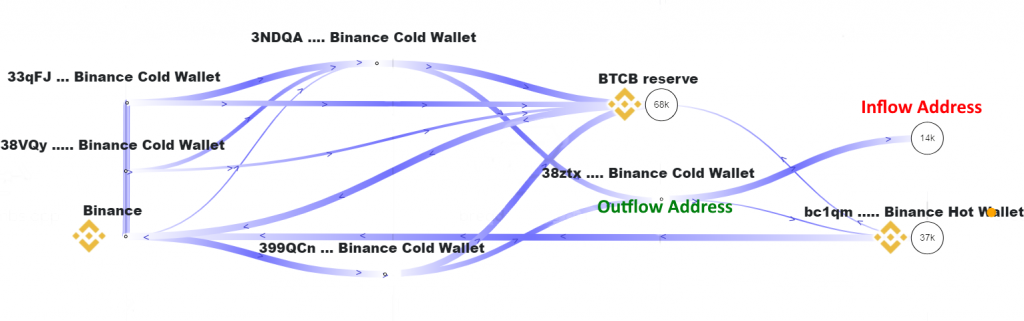

Going to analyze the movement we can see that the outflow starts from a Binance address that is well integrated into the Binance ecosystem, i.e., any movement to and from occurred exclusively from and to Binance addresses.

What does not add up, and what makes this most likely an internal Binance movement, is that the outflow did not occur from the classic Hot Wallet, but occurred from a secondary Cold Wallet, emptied, and with the routing of the total amount of Bitcoins to a virgin address, but with a typical trace and repeatedly used by Binance to “mark” its addresses, this for example has happened before during Audits.

We can therefore regard it as an internal movement that has nothing to do with accumulation.

What should give pause for thought is yet another huge internal Binance move, from a known Binance address to a virgin address, in the middle of the European night and late in the U.S. evening with markets closed, with no advance notice of movement.

The obvious attempts at manipulation, even in light of connections and mutual support with opaque onchain services, should make users reflect on which onchain services should be deemed trustworthy, transparent, and which ones lend themselves to power plays and collusion with the sole purpose of misleading users and draining them of their Satoshi.

BtcInOutAlert

Other Charts