As always, the answers rely in the blockchain. Each UTXO corresponds to a block, and each block corresponds to a date. Each date corresponds then to a precise value of Bitcoin.

We have removed all the Exchange and custodial addresses. We have aggregated the values in ranges of $500. This to reduce the size of the chart and give a more representative idea of the purchase ranges.

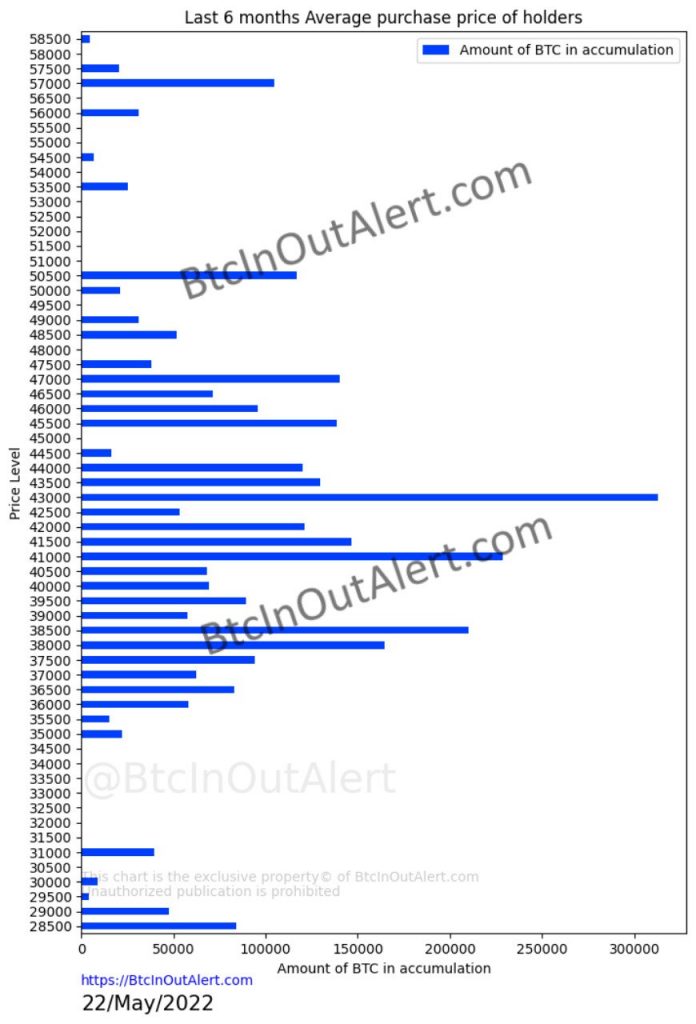

Last 6 months

The first figure evaluates the last 6 months of UTXO, so from 23/November/2021 when Bitcoin was quoted around $58,000

The result is that over 95% of those who have accumulated in the last 6 months are at a loss, at an average accumulation value of $42,293

Last year

It doesn’t fare better with last year’s UTXO datasets On 22/May/2021 Bitcoin was quoted as $38,150

Holders from the past 365 days have an average accumulation price of $44,048, higher than holders from the past 6 months

Just over 91% of the dataset is at a loss.

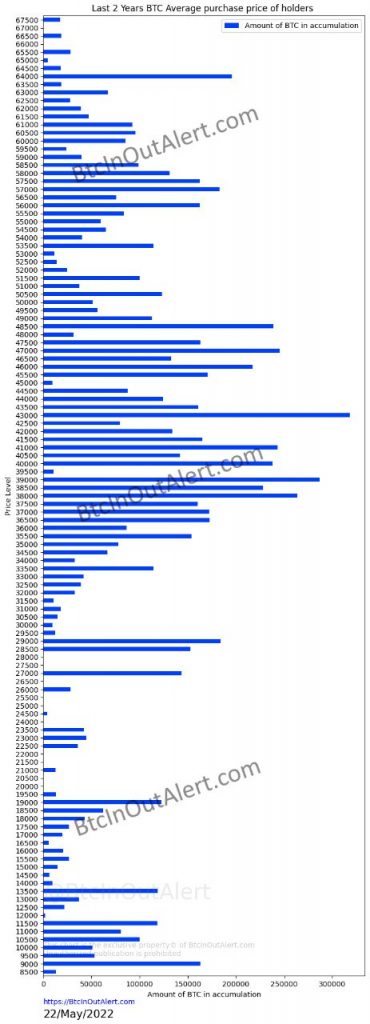

Last 2 years

Utxo dataset from 22/May/2020. Bitcoin was quoted at $9,170

The result is that the holders of the last two years, those who have not sold, have an average accumulation price of around $41,001

80.46% is currently at a loss (at today’s price of around $ 30,000)

The average purchasing being at 40k, means therefore that those who bought in the last two years, either sold their bags already making profit, either are holding despite current loss.