MicroStrategy and Bitcoin. Microstrategy is one among the leading Nasdaq-listed companies that has abandoned dollar reserves to accumulate Bitcoin. In this post we are going to analyze which addresses are most likely to be attributable to MicroStrategy.

[adinserter name=”CoinAdsenseRotation”]

Onchain data are interpretive, but at the same time offer a huge amount of data, public, analyzable, and helping to identify with relative certainty who holds the private keys to a Bitcoin address.

[adinserter name=”CoinAdsenseRotationMobile”]

Much information that helps identify and confirm addresses comes from official sources, such as the SEC. In one of the latest reports published by MicroStrategy on the SEC website dated September 20, 2022 it mentions :

As of September 19, 2022, MicroStrategy, together with its subsidiaries, held an aggregate of approximately 130,000 bitcoins

https://www.sec.gov/Archives/edgar/data/1050446/000119312522247427/d355455d8k.htm

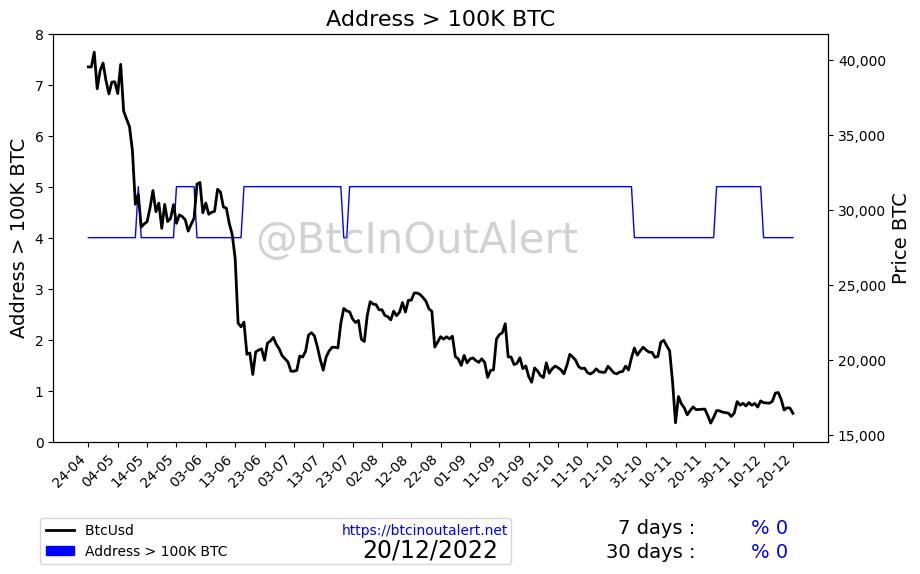

We therefore know from official documents, with certainty, that on September 19, 2022, MicroStrategy, owned about 130,000 Bitcoins. We then analyze the chart with addresses above 100k provided on our website:

We have to date 4 addresses greater than 100k, of which 3 are officially traceable to Binance, addresses certainly owned by Binance officiated by multiple sources. That leaves only one with 137,000 as of September 19, 2022, which is 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd is MicroStrategy?

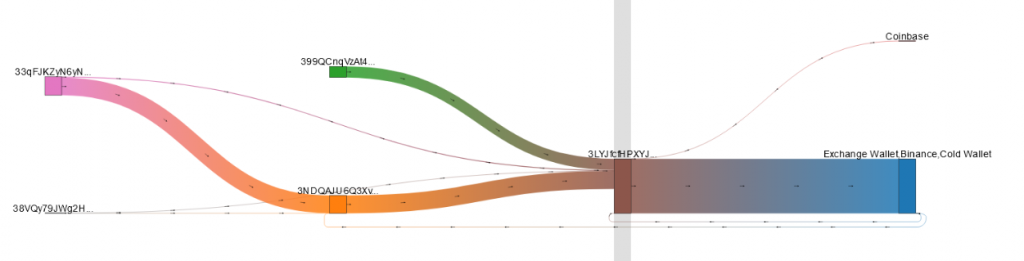

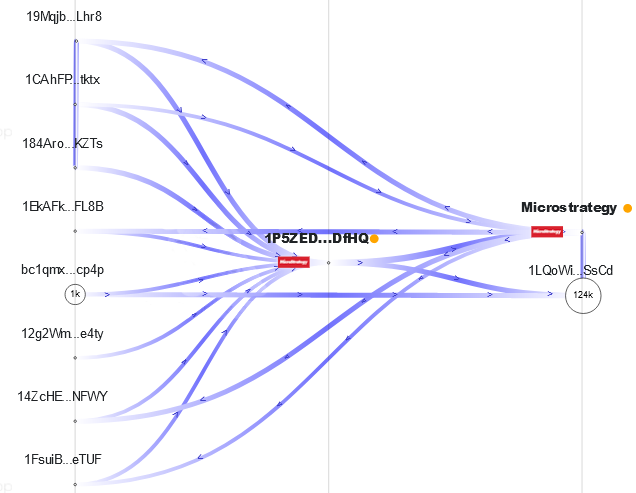

Address Analysis 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ

The analysis of address 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd often pales balances that correspond with what MicroStrategy officiates through SEC reports. Address 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd is a probable change of address 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ traceable to the same owner, and has connections to address 1FzWLkAahHooV3kzTgyx6qsswXJ6sCXkSR

A cross-reference of the two addresses brings confirmation, namely, that often the sum of the two addresses almost faithfully met the balances reported to the SEC and by Tweets.

Analyzing the latest SEC memo, we know that MicroStrategy owns “approximately 130,000 Bitcoins, which corresponds to what we see in the balance, or 137.845 BTC

Some analysts criticize and deny the possibility that the address 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ before and consequently 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd after is the address traceable to MicroStrategy, and this is explained as “the address 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ was active before MicroStrategy started buying Bitcoin,” and this is absolutely true, but it can be explained.

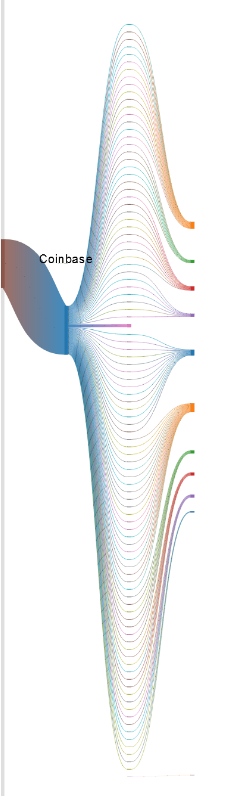

CoinBase and the partnership with MicroStrategy

MicroStrategy and its subsidiaries, according to multiple sources, use CoinBase both as an OTC (Over the counter buying and selling) service and, more importantly, as a custodial service.

A cross-check of address balances and communications from the SEC, MicroStrategy, and Saylor’s Tweets confirm that addresses 1LQoWist8KkaUXSPKZZHNvEyfrEkPHzSsCd , 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ and 1FzWLkAahHooV3kzTgyx6qsswXJ6sCXkSR are controlled by CoinBase and are Bitcoins traceable with high probability, almost certainty, to MicroStrategy, and that the Bitcoins in the balance are wholly or close to 100 percent traceable to MicroStrategy.

[adinserter name=”CoinAdsenseRotationMobile”]

[adinserter name=”CoinAdsenseRotation”]

Update : following this post, a further follow-up post has been published which you can follow at this link https://btcinoutalert.net/a-new-microstrategy-bitcoin-address-confirmed-by-on-chain-analysis-and-public-data/

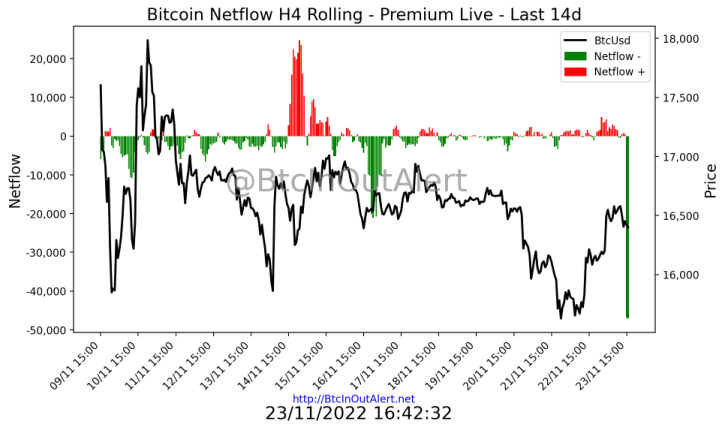

Other Charts