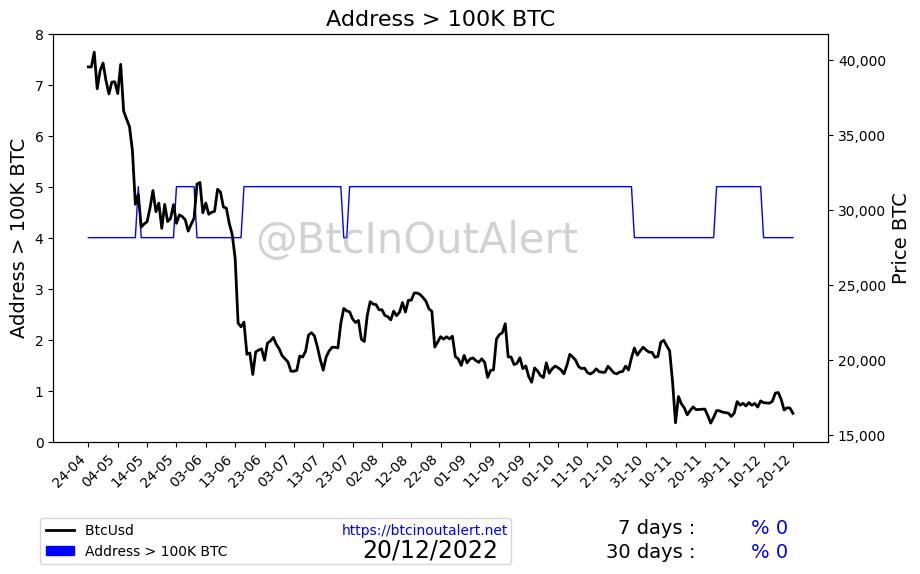

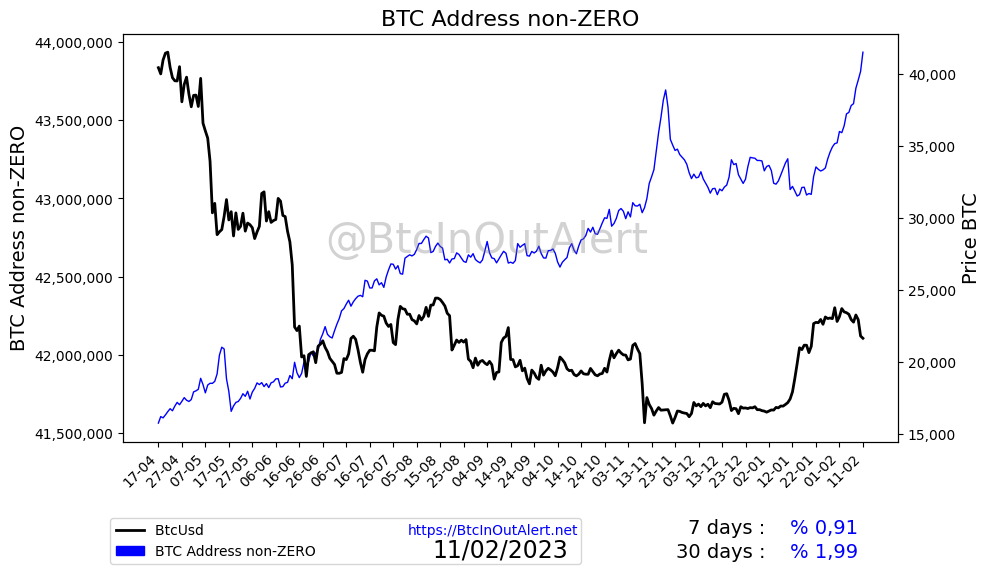

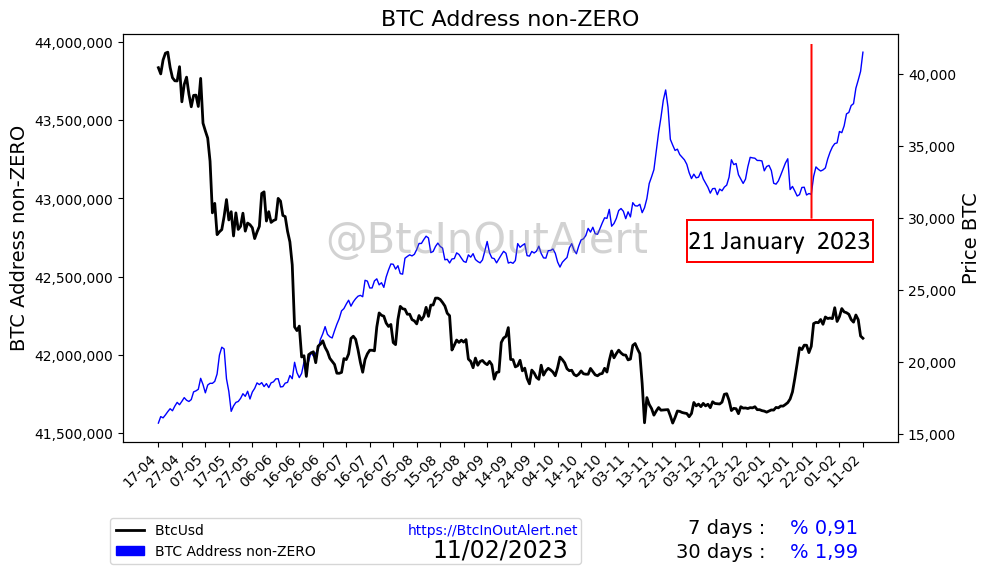

The past 3 weeks have witnessed a major event in address distribution, a mighty rise to ATH of non-Zero Bitcoin addresses, or the summation of all Bitcoin addresses containing at least 1 satoshi.

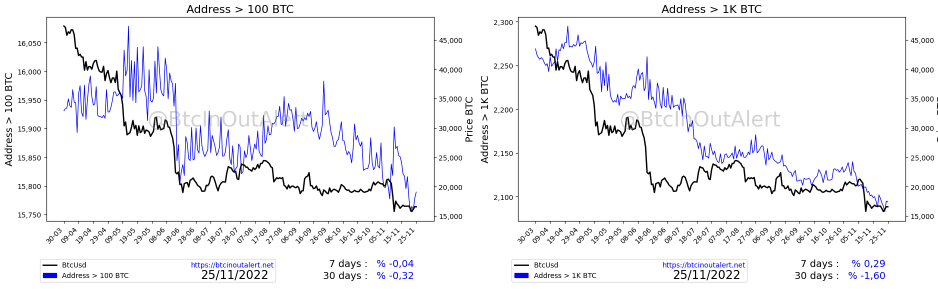

In the image depicted above, it can be seen that the last three weeks have seen a parabolic ascent of this metric, a parabolic ascent that is not present in any other metric regarding the distribution of addresses; in fact, for the most part they are declining or at best stable.

Numerous Bitcoin newspaper, Twitter and Telegram channels have portrayed this event as positive, as a sign of important Bitcoin accumulation by Retail investors, but is this really the case or can it be explained differently?

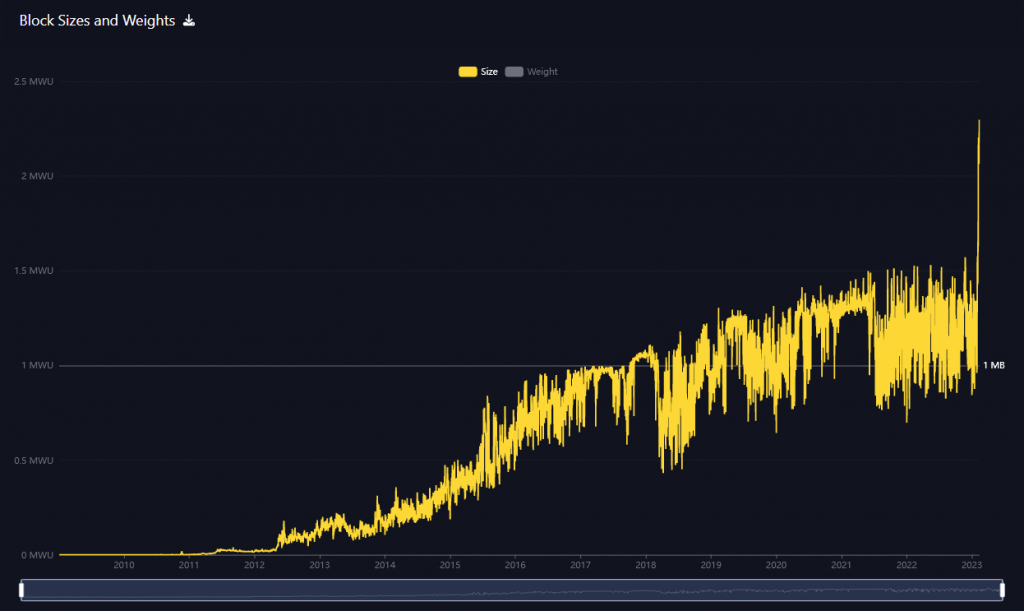

The Block Size, what happens?

The above image shows the total block size of bitcoin. As is easy to see, a disproportion to the historical graph is evident. The Block Size has been growing steadily as transactions have increased, but for the past few days it has had an abrupt increase, doubling from the historical. Once again, why this anomaly ? How is it possible to explain everything ?

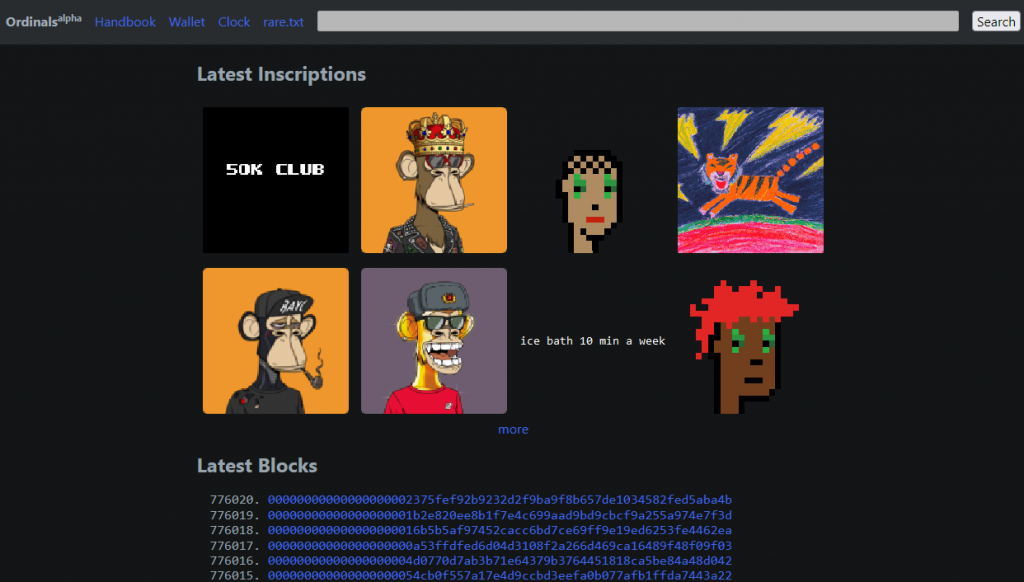

Ordinals’ responsibilities

As of January 21, 2023, the race for Ordinals, i.e., digital artifacts, has begun. Ordinals are created by enrolling sats, and to them are included content, such as an image, an HTML url, text, in order to keep these artifacts one must keep the transaction (UTXO), i.e., an unspent transaction.

If we apply a separator exactly on the date when the publication of Ordinals began here is where this anomalous movement of the distribution of non-Zero addresses is explained.

As always, onchain data tells objective data, while analytics is essential to really understand what is happening.

How will Ordinals affect Bitcoin ?

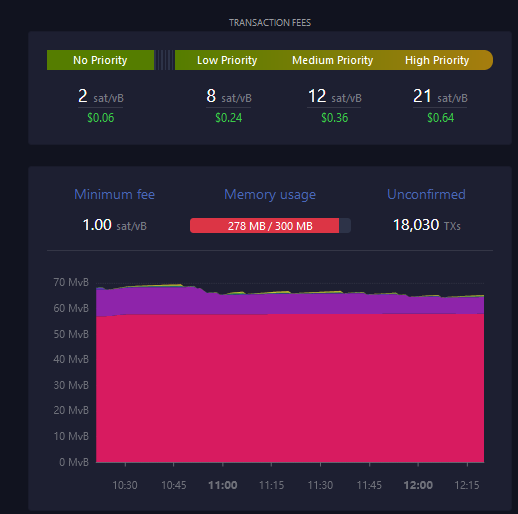

The past few hours have seen a major increase in transaction verification wait times, and an increase in transaction costs.

How sustainable is all this? What can we expect in the long term? We will explore this in more detail in the near future