[adinserter name=”CoinAdsenseRotationMobile”]

[adinserter name=”CoinAdsenseRotation”]

After a short guide on What is Netflow, if you haven’t read it we recommend you do since it gives you the minimum logical foundation on what Netflow is and how to interpret it, today we will focus on another valuable metric : the Distribution of Bitcoin addresses.

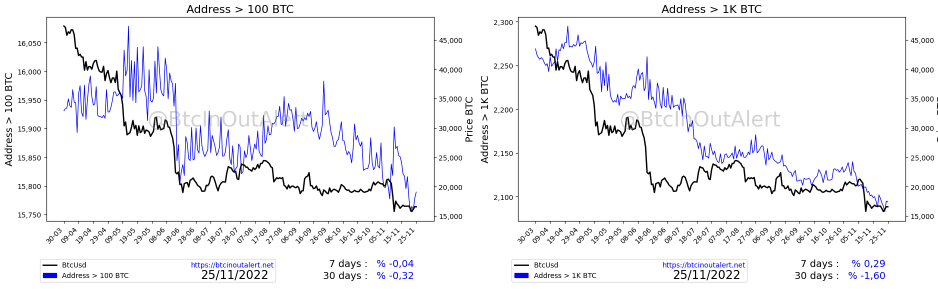

All present charts you will find on BtcInOutAlert.

Address distribution is one of the useful metrics in near crypto price prediction through onchain analysis. It is easy to read, within anyone’s reach, and it is objective data; all the data is in Blockchain, and even through its history, it is possible for anyone to do an analysis for crypto price prediction.

Our charts are divided as:

As you can see by viewing our Bitcoin address distribution charts, there are clear disparities between increase and decrease based on quantity. Let us analyze the extremes to understand who and how they are increasing and/or decreasing their balances.

Increasing Bitcoin addresses

Right now on the rise we have two absolute metrics, namely the very small ones and the very large ones. Below you can see addresses greater than 0.1 Bitcoin (at current exchange rate $1650) and addresses greater than 10,000 Bitcoin.

Addresses above 10,000, as we have already previously analyzed in the post “Accumulation in progress?” are almost all addresses that can be traced back to exchanges, confiscated or old addresses that have been stopped for many years, so even if they are increasing they cannot be considered accumulations, far from it, they are often Bitcoin that enter exchanges to be sold and/or exchanged for other currencies.

Addresses above 0.1 Bitcoin although considered accumulations must be kept in mind that, especially in recent weeks, there has been a massive outflow from centralized exchanges the result of user distrust after the failure of FTX, but we can consider the metric in accumulation.

Decreasing Bitcoin addresses

Now let us analyze the extremes on the side of degrowth :

As can be seen there is a slight decrease in addresses above 100 and 1,000 Bitcoin, a decrease significantly lower than the percentages of over 5 percent of 0.1 Bitcoin addresses.

So the question is, who is increasing and who is decreasing their Bitcoin reserves? The answer is quite clear, small addresses increased exponentially, while large addresses lightened their reserves.

What often escapes notice, however, is the weight that metrics have; bitcoin accumulated by small wallet are by far smaller amounts than those issued by big wallet.

If we also try to do a very rough sum, we will notice that the weight of the two distributions are totally different. A decrease of 1.60% has a much greater weight than the 5% increase in addresses above 0.1 Bitcoin.

This is an important element to understand for proper analysis. Data must be seen and read as a whole, and each metric must be given the correct weight, otherwise the risk is to make errors in analysis.

Conclusions

This post is only meant to pose evidences that will hopefully be useful to you in the future for a better reading of the data. As always, it’s up to you to do the final analysis, and these values are very important data that cannot be missed in an analyst’s data set.

Our role is to provide data, and BtcInOutAlert publishes daily updates of distribution metrics; the update occurs within minutes of the daily close. Support us by sharing our link.

Other Charts